Zampost EMS

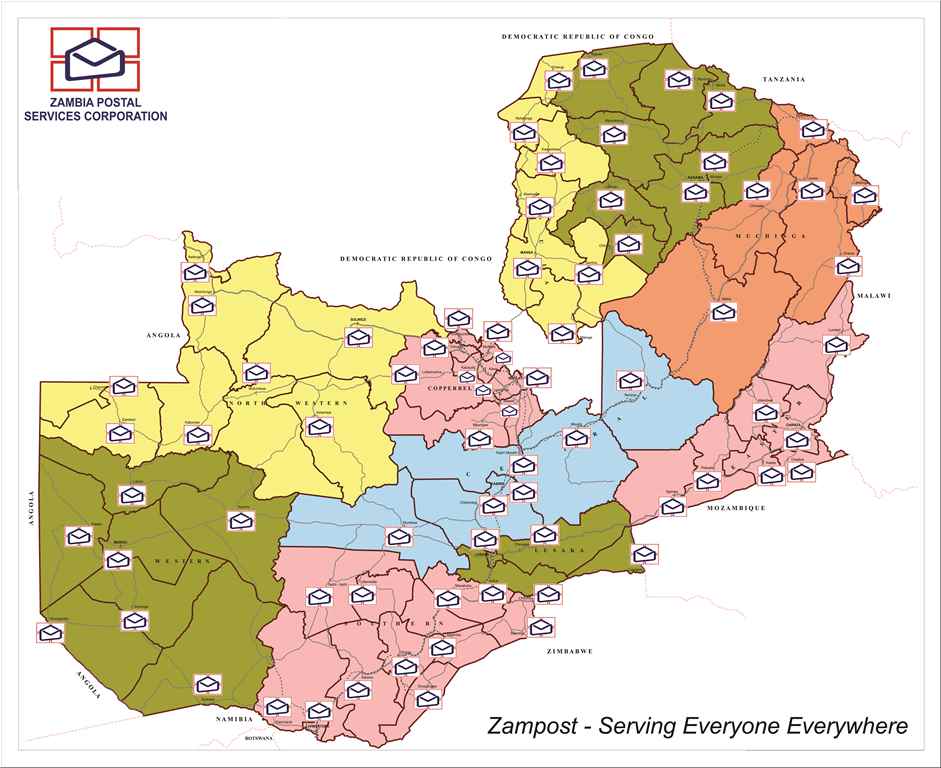

Use our ZAMPOST-EMS to deliver your mail to anyone, anywhere.

Please Call our Customer Care on 0955-007678

#heretoserve #servingeveryoneeverywhere

Latest News

Latest news and announcements from Zampost

How Can we help you?

Freight & Fowarding

For all your cargo clearing and cargo deliveries, you can use the Zampost freight and fowarding service.

Read more